Running a start-up with limited capital is tough, right?

You know you have a brilliant idea, and you know you could ROCK THE WORLD if you just had a little cash to implement it. So you shop your genius idea around, offering investors the chance to get in on the action. And then you start to lose your mind…

The challenge of raising capital for a new enterprise brings up many psychological and (dare we say it?) spiritual issues with regard to our relationship to money. It’s stretching me, inside and out. Sound familiar? Then check out these 5 Ways I’ve been reframing my relationship with money. Total lifesavers!

1) Lead with the Impact

In her recent book Sacred Success, Barbara Stanny warns: “Tell a woman she can substantially increase her income, and she may get excited about the possibility, but not enough to stretch beyond her comfort zone, a prerequisite for financial success.”

Don’t let money be your driving force. When I started to raise money, I was so focused on making sure that my potential investors got a return on their investment that I spent too much time on the numbers and too little time communicating the impact we were having in women’s lives.

The excessive focus on the money aspect of my business began to consume my thoughts and I started to lose my “juice.” Once I started to lead with my “why,” to help women actualize themselves in business and as leaders, I attracted more aligned investors and supporters that shared my mission, and I started to get real traction. But more importantly, I felt more energized and resilient, even in the face of “no.”

2) Do the Math!

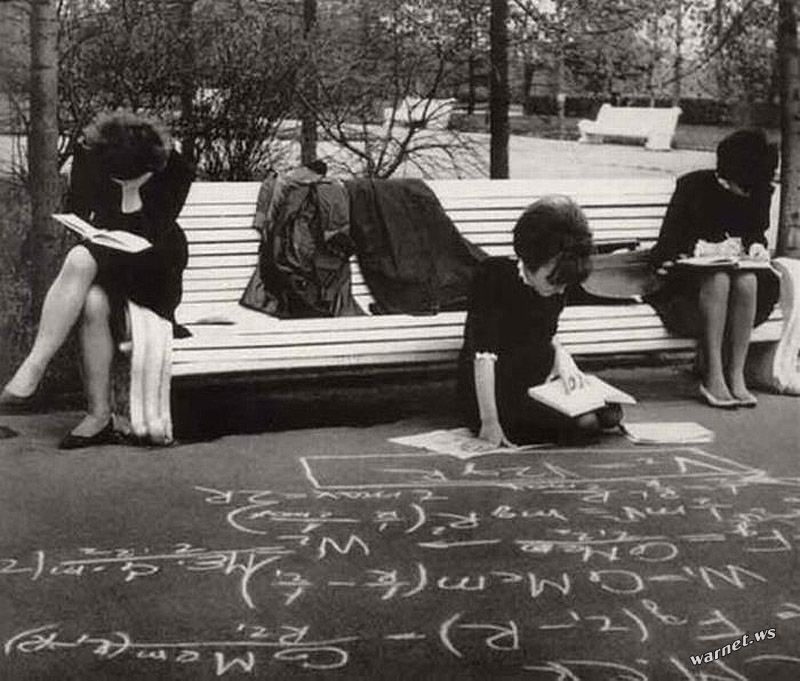

Now that you have your priorities straight, it’s time to make friends with Excel. If I had a dime for every woman that has said “I suck at math!” I would be a rich lady. I am guilty of this myself – even with an MBA, I dreaded building my own financial statements as an executive and now still as an entrepreneur.

You cannot be successful in business if you don’t know your numbers inside and out. This is not to say that you should do everything yourself: if math isn’t your super power, hire a financial management company that can do your bookkeeping (because who has time?). More importantly, they can do financial modeling and projections for you (key if you are growing or scaling).

The important thing is that you understand your costs and expenses, and where your revenue is coming from. If you don’t know your numbers, the chances of reaching your goals are practically nil.

Understanding the economics of your business and the different scenarios that could play out are essential for forecasting viability, profitability and cash flow. You can’t reach what you can’t see, sisters, so roll up your sleeves and dive in. It’s not as bad as you think, and the confidence you gain from the visibility is invaluable.

3) Alignment is King (and Queen)

This is a discipline. If your soul desires and your financial goals are not in line with one another, success will not be fulfilling or sustainable. If you are looking for investors, partners, clients or customers, remember that you are also investigating the right fit for your business. If you take on a customer or partner because they have deep pockets, but they are not aligned with the depth of your purpose, they will cause you pain, and cash, in the long run.

“If your soul desires and your financial goals are not in line with one another, success will not be fulfilling or sustainable.”

When possible, make sure you have enough runway so you can be selective and discriminating when aligning with your cash sources – these are the people can help to shape your brand and multiply your revenue efforts, but only if you want the same things!

4) Keep an Abundant Mindset

This one is tricky, because often times when we are dealing with money, there is fear – fear that we don’t have enough or, conversely, that we will lose the money we have thus far. As women I think what we fear the most is that we will end up “bag ladies” on the streets without support or resources.

When we manage our money from a place of fear, we are less likely to take risks that could lead to wonderful opportunities and success, or we stay small in our aspirations and don’t allow for a more expanded vision of what we can do.

Here’s a little practice I do when I start to feel the walls of fear shrink my feeling of what’s possible:

Find a spot in nature with an amazing view – the top of a mountain, overlooking a vast body of water, anything that shows you the abundance and richness that surrounds us on earth. If you have limited access to nature, call up an inspiring place in your mind. Breathe deeply, take in the view, and align your thoughts with the vastness of the beauty, power, and abundance before you. This is a part of you, just as it’s a part of the earth. Own it.

5) Spend Time with People You Admire

Notice that I didn’t say spend time with other financially successful people. My husband and I have a wide variety of people in our community, and while some are wildly successful by traditional standards, many are successful in other ways: they have lots of close connections, they spend time outdoors, they create art, cook, and relish their lives.

Surrounding myself with people I admire, in business and in my personal life, has inspired me to be my best – not do the most – because I naturally want to emulate what I admire. When I come from this place, the money always follows.